The Scarcity Illusion: How Hype and Shortages Control Our Choices

Why do people rush to buy a limited-edition phone they don’t really need, pay triple the price for sold-out concert tickets, or grab the last sweater on a rack—even if it’s not their size? It’s not just about wanting something—it’s about scarcity. When we think something is rare or hard to get, our brains convince us it’s more valuable, triggering a sense of urgency that often overrides logic.

Think about the chaos of Black Friday sales, where customers fight over discounted TVs they never planned to buy. Or the way people scramble to get into an exclusive restaurant, even if they weren’t that interested in it before. From sneaker drops to panic-buying during a crisis, scarcity controls our decisions more than we realize.

In this article, we will discuss concepts like FOMO (fear of missing out), loss aversion, and the scarcity heuristic—key psychological biases that, as behavioral economics shows, fuel these impulses and make us act before we think. But once we recognize these mental traps, we can stop falling for them and make smarter choices in a world that constantly tries to make us panic-buy.

The Psychology Behind Scarcity-Driven Decisions

Scarcity taps into some of our deepest psychological biases, making us act impulsively, overvalue things that are hard to get, and sometimes even ignore logic. Behavioral economics explains why our brains are wired to panic when something seems rare, and three key concepts help break down this behavior:

1. FOMO: The Fear of Missing Out

FOMO isn’t just about seeing your friends at a concert you skipped—it’s a powerful psychological driver that makes us crave what we can’t have. When we see limited-edition sneakers, exclusive event invites, or flash sales counting down the seconds, our brains go into overdrive. What if I don’t act fast enough? What if I regret not getting this? Marketers know this well, which is why they use phrases like “One-time-only” and “Selling out fast” to push us into making quick (and often irrational) decisions.

2. Loss Aversion: The Pain of Missing Out

Our brains are wired to fear loss more than we value gain. This means we’re more upset about losing an opportunity than we are excited about finding one. That’s why people will overpay for resale tickets to an event they weren’t even that interested in—because the idea of “missing out” feels worse than the financial hit. It’s also why people hoard items during shortages, even if they don’t need them immediately. The thought of not having toilet paper during a crisis feels way scarier than the logic of whether they actually need 50 rolls.

3. The Scarcity Heuristic: If It’s Rare, It Must Be Valuable

Our brains take shortcuts when making decisions, and one of the biggest is the scarcity heuristic—the belief that if something is hard to get, it must be special. Think about a restaurant with a long waitlist. Even if you’ve never heard of it before, suddenly, you need to try it. Limited-edition sneakers, collector’s items, and “members-only” clubs all use this trick to make us believe something is worth more just because it’s not easily available. The truth? Often, the rarity is artificially created to make us want it more.

These psychological forces shape our everyday choices, making us spend more, chase trends, and sometimes even fight over things we don’t really want or need.

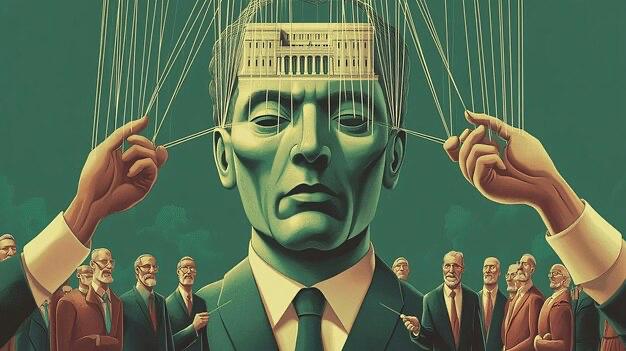

How Businesses Exploit Scarcity for Profit

Scarcity is a powerful tool—and businesses know exactly how to use it to make people spend more. Whether it’s through limited-edition drops, price manipulation, or crisis-driven marketing, companies create a sense of urgency that overrides logical decision-making. Here’s how they do it:

1. Artificial Shortages & Limited Editions: Making Common Things Feel Rare

Some products aren’t actually hard to get—companies just make them seem that way. Luxury brands release “limited-edition” goods such as handbags, even when they could easily make more. Fast-food chains like McDonald’s and Starbucks bring back special items for a short time—like the McRib or Pumpkin Spice Latte—to make people rush to buy before they disappear again. By controlling supply, businesses create hype, making products seem more valuable than they really are. Online businesses also use digital scarcity tactics, such as countdown timers, to pressure customers into purchasing quickly. For instance, cracku, an online student coaching portal, used OptinMonster to create countdown timers combined with limited-time offers, increasing conversions by 300%.

2. Dynamic Pricing & Resale Markets: The More You Want It, the More It Costs

Ever checked a flight price, only to see it jump a few hours later? That’s dynamic pricing at work. Airlines, hotels, and ride-sharing apps like Uber use demand-based pricing to maximize profits, making customers feel pressured to book before prices rise even more. The same strategy fuels resale markets—scalpers buy up everything from gaming consoles to collectible trading cards, then resell them at outrageous prices. Since buyers believe they won’t get another chance, they pay far more than the item’s actual worth, falling right into the trap of artificial scarcity.

3. Panic-Buying & Crisis Marketing: Fear Sells

When people feel uncertain, they panic-buy. During the COVID-19 pandemic, for instance, toilet paper and hand sanitizer flew off shelves, not because there was a real shortage, but because people thought there was one. Businesses fuel this fear by adding messages like “Only 3 left in stock!” or “Selling out fast!”, triggering urgency and making shoppers act before thinking. While some companies genuinely struggle with supply issues, others use these tactics to artificially boost demand and increase sales. Even digital platforms use FOMO to drive action. Tinder, for example, notifies inactive users that their profiles won’t be visible unless they start using the app again. This subtle urgency triggers the same fear that fuels panic-buying—if people believe they might miss an opportunity, they act immediately. With 69% of millennials experiencing FOMO and 60% making impulse purchases because of it, businesses leverage this psychological trigger to their advantage.

Is it good or bad?

Scarcity tactics can be both good and bad, depending on how they are used. On one hand, they create excitement and give consumers a sense of exclusivity—owning a limited-edition item can feel special. Businesses also use scarcity to manage supply and demand, ensuring they don’t overproduce. However, these strategies often lead to unnecessary panic and overspending. People end up buying things they don’t need, overpaying for products, or feeling pressured to make quick decisions without thinking. In extreme cases, artificial scarcity fuels stress, frustration, and even financial loss. While scarcity can add value, it becomes harmful when companies manipulate consumers into making irrational choices.

How to Avoid Falling for Scarcity Traps

Scarcity-driven marketing can make you feel like you have to buy something right away, but with the right approach, you can avoid overpaying and making impulsive purchases. Here’s how:

- Pause Before You Buy.

- Compare Prices and Alternatives.

- Set a Price Limit.

- Ask Yourself: “Would I Rather Have the Money?”

- Think About “Cost Per Use”.

- Learn to Love Patience.

If you feel pressured to buy something because it’s “selling out fast,” take a step back. Ask yourself: Do I actually need this? Will I still want it in a week? Often, the urgency fades once you give yourself time to think.

Don’t fall for the idea that one item is your only option. Whether it’s a gadget, clothing, or even event tickets, check if there are similar or better-priced alternatives. Brands use scarcity to make you ignore other choices.

If you really want something, decide in advance how much you’re willing to pay. If the price goes beyond that, let it go. This prevents you from getting caught in the moment and spending more than it’s worth.

Instead of focusing on what you’re “missing out on,” flip the question: Would I rather have this item or the cash in my account? Imagining the money as an option can make you rethink an impulse buy.

When looking at the price, ask: How often will I use this? A $300 jacket worn daily for a year is a better deal than a $100 trendy bag you’ll use twice. This stops you from wasting money on hype-driven, one-time-use items.

Most “rare” items come back eventually—sometimes better and cheaper. Play the long game. Brands thrive on making you feel like you must buy now, but those who wait often get the best deals.

By applying these strategies, you take control of your money instead of letting businesses and hype dictate your spending.

Scarcity plays on our fears—of missing out, of losing opportunities, of being left behind. It makes us rush, spend, and chase things we don’t actually need. Businesses know this, and they use it to their benefit, creating artificial urgency to make us act before we think.

But here’s the truth: most of the time, you’re not really missing out. The “last chance” isn’t truly the last, and the urgency is just an illusion. When you pause, reflect, and take control of your decisions, you break free from these psychological traps. Real value isn’t in what’s rare—it’s in making choices that truly serve you. The next time you feel pressured to buy, remember: you hold the power, not the marketing tactics.

– By Zhanar